Child support is NOT dischargeable in any type of bankruptcy. The welfare of minor children is of primary importance throughout the state and federal court system.

Child support is NOT dischargeable in any type of bankruptcy. The welfare of minor children is of primary importance throughout the state and federal court system.

Priority debts are nondischargeable in bankruptcy. This means that if you owe any outstanding child support debt, it will not get wiped out by your bankruptcy discharge. As a result, filing for Chapter 7 bankruptcy will not eliminate your obligation to pay child support and make up any missed payments.

But you still can get some benefit from declaring bankruptcy. Although you cannot erase child support payments, if you file for Chapter 7 protection and most of your other debts are erased, your budget will include new extra cash, which will make it easier for you to make your scheduled support payments on time.

Even choosing a Chapter 13 wage earner plan will lower your monthly payments to creditors, leaving you with more available cash to meet your support commitments.

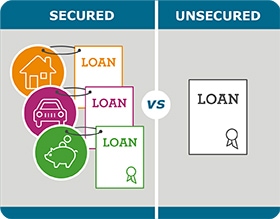

The type of debt you have plays an important role in what happens if you default on a loan. There are two types of debt. Secured and unsecured debt.

The type of debt you have plays an important role in what happens if you default on a loan. There are two types of debt. Secured and unsecured debt.