Chapter 13 bankruptcy is another form of bankruptcy relief. Unlike Chapter 7, a Chapter 13 bankruptcy allows you to keep all of your property (may vary in certain situations) and pay back a portion, if not all, your debt over three to five years. Chapter 13 is an effective tool to handle certain types of debt or real property issues. Some of the reasons a Minneapolis Chapter 7 bankruptcy attorney might recommend Chapter 13 bankruptcy include:

Chapter 13 bankruptcy is another form of bankruptcy relief. Unlike Chapter 7, a Chapter 13 bankruptcy allows you to keep all of your property (may vary in certain situations) and pay back a portion, if not all, your debt over three to five years. Chapter 13 is an effective tool to handle certain types of debt or real property issues. Some of the reasons a Minneapolis Chapter 7 bankruptcy attorney might recommend Chapter 13 bankruptcy include:

- Not all individuals will qualify for Chapter 7, so Chapter 13 might the only available relief.

- Chapter 13 can be an effective way to handle tax debt.

- Chapter 13 provides relief from mortgage or car loan arrears.

- Under special facts Chapter 13 is a mechanism to “lien strip” a wholly unsecured junior mortgage loan.

Chapter 13 Bankruptcy Eligibility

Chapter 13 requires regular monthly debt payments to a Chapter 13 trustee. As a result, not everyone will qualify for Chapter 13. You must prove to the court that you have enough “disposable income” to cover all required payment obligations. If you have irregular income or income that is too low, the court may not approve your repayment plan. Additionally, if your debt is too high, you may also be ineligible. In Chapter 13, secured debts cannot exceed $1,149,525 and your unsecured debts cannot exceed $383,175.

Chapter 13 Repayment Plan

The key component to a Chapter 13 bankruptcy is the repayment plan. You file paperwork with the court that proposes a plan to pay your creditors at least some of what you owe them. You must have “disposable income” after allowed expenses to be able to propose a plan. After you file your plan, a court must approve the repayment plan. Then, instead of making your payments to creditors, you make monthly payments to a Chapter 13 bankruptcy trustee who then pays your creditors. How much you pay and who receives payment first depends on numerous factors. Your bankruptcy attorney will help you better understand this process. Each case is specific to the individual’s unique situation.

Chapter 13 requires full payment of certain debts and partial repayment of others. Specifically:

Priority Debts

Certain types of debts must be kept current and any arrears paid in full during the repayment period. These include child support, alimony, wages owed to employees, bankruptcy attorney fees paid through the plan and certain taxes.

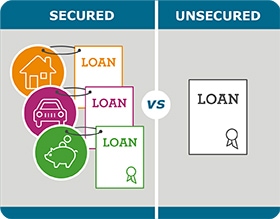

Secured Debts

Secured debts are monies owed that are secured by collateral. The most common examples are a car or house. If you wish to keep the property, the repayment plan must provide for regular, timely payments of all secured debts. Additionally, you must repay arrears (late payments) in your plan in full during the repayment period. Fixing or holding interest is a common occurrence. If a secured loan is paid off in full prior to the end of your repayment plan, you may have a “step up” in your available income to be paid into the plan.

Unsecured Debts

In most Chapter 13 repayment plans, general unsecured debts are repaid only in part, and the rest are discharged at the end of the repayment plan. The most common types of debt in this category are credit cards, personal loans, medical debt and utilities.

Nondischargeable Debts

Under the bankruptcy laws, bankruptcy cannot discharge certain types of debts. In addition to Priority Debts, discussed above, other nondischargeable debts include student loans (in most cases), government fines, payment of restitution, DUI-related death or personal injuries, unlisted creditors and a few other special categories.

How long will My Chapter 13 Plan Last?

Your income determines the length of your repayment plan. If your average household monthly income (the average of the 6 months of income prior to the filing date) is greater than the median household income for your state, based on your household size, then your repayment plan proposal must be for 60 months. However, if you income is lower than the median, you may propose a 36-month plan. In some cases, a below-median debtor may wish or need to extend the plan beyond the 36 months to allow for affordable monthly payments.

What Happens if I Stop Making Payments?

You will remain under the protection of the bankruptcy court (from garnishment, collections), etc. as long as you stay current in your repayment plan and meet other obligations dictated by the plan. However, if life circumstances do not allow you to finish the plan (e.g. job loss, illness), you may have an opportunity to modify the plan or convert to a Chapter 7 bankruptcy. It is best to consult your attorney before you miss any payments. It is much easier to consider options before your plan payment is late. A court can dismiss your plan if you don’t make payments.

Special Circumstances in Chapter 13

In some instances, Chapter 13 bankruptcy allows for a second mortgage or HELOC to be stripped from the property. In order to “strip” a junior lien from a property, or convert to an unsecured debt, your Chapter 13 attorney must file special motions with the Bankruptcy Court. Additionally, Chapter 13 bankruptcy “crams down” car loans. Simply put, your car’s value is reduced to the amount you owe on the car loan. These situations are very fact specific and not all cases will qualify for a lien strip or “cramdown.” Your bankruptcy attorney can help you better understand if these options might be available to you.

Case Completion

Once you have made all the payments under your repayment plan, all the remaining debts will be wiped out. Before your discharge, you must show the court that you are current on any child support and/or alimony payments and completion of the required debtor education course.

To learn more about Chapter 13 bankruptcy, schedule your free consultation with Minneapolis Chapter 13 bankruptcy attorney Gregory J. Wald. Call (952) 921-5802.

The type of debt you have plays an important role in what happens if you default on a loan. There are two types of debt. Secured and unsecured debt.

The type of debt you have plays an important role in what happens if you default on a loan. There are two types of debt. Secured and unsecured debt. Chapter 13 bankruptcy allows people with an income the option of creating a plan to repay part, or all of their debt when they are experiencing hardship. This is why it’s known as the “Wage Earner’s Plan.” When filing for Chapter 13, the debtor has agreed to a repayment plan of their debts over a course of three-to-five years.

Chapter 13 bankruptcy allows people with an income the option of creating a plan to repay part, or all of their debt when they are experiencing hardship. This is why it’s known as the “Wage Earner’s Plan.” When filing for Chapter 13, the debtor has agreed to a repayment plan of their debts over a course of three-to-five years. If you are thinking about filing for bankruptcy, contacting an experienced attorney is your first step. Below we list some differences between filing for Chapter 7 vs Chapter 13 bankruptcy to give you an idea of what to expect.

If you are thinking about filing for bankruptcy, contacting an experienced attorney is your first step. Below we list some differences between filing for Chapter 7 vs Chapter 13 bankruptcy to give you an idea of what to expect.